Hawaii Capital Gains Tax 2025. Long term capital gains are taxed at a maximum of 7.25%. You earn a capital gain when you sell an investment or an asset for a profit.

Long term capital gains are taxed at a maximum of 7.25%. “this bill would be devastating to savings and investment in our state.

The legislature finds that hawaii has a capital gains tax rate of 7.25 per cent, which is lower than the tax rate many of the state's residents pay on their wages and salaries.

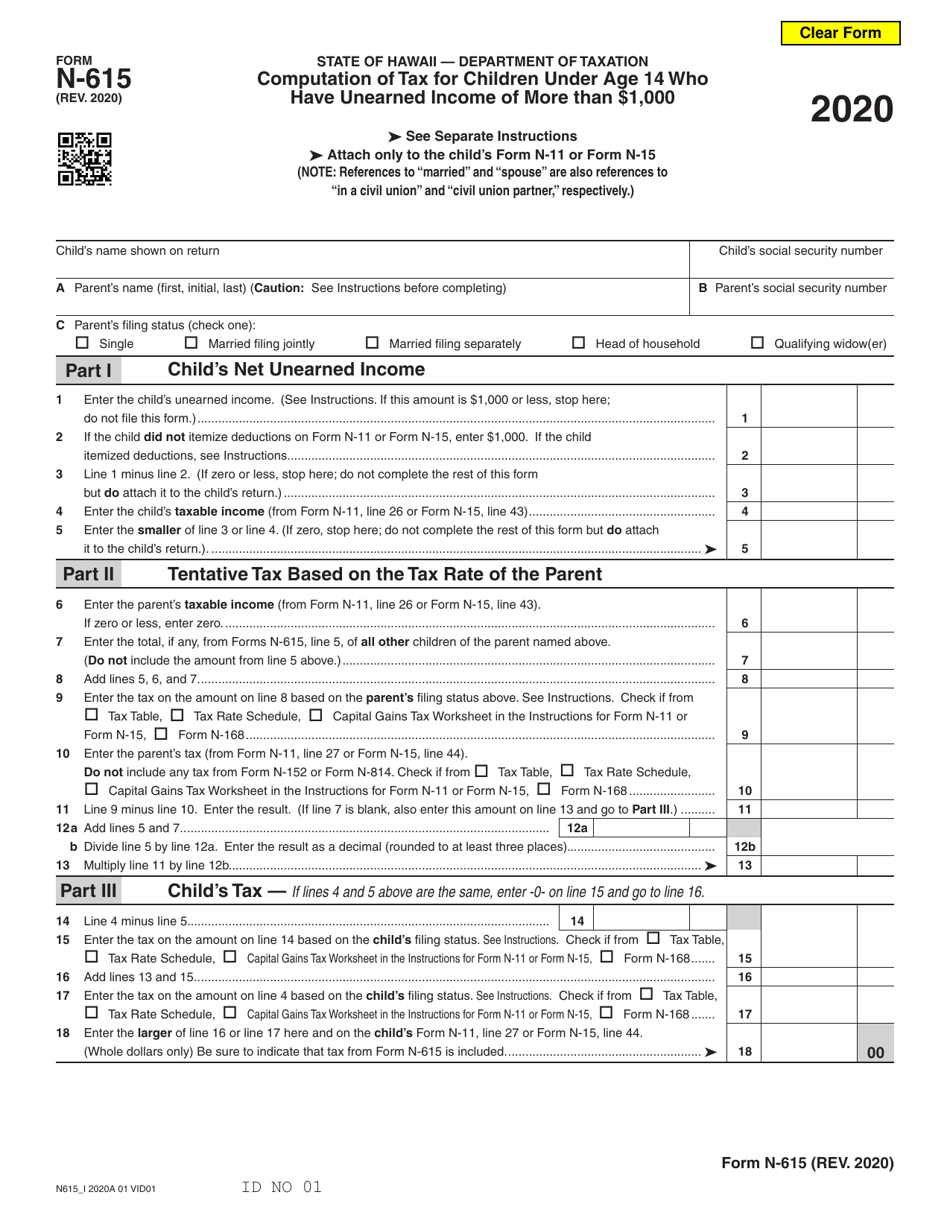

hawaii capital gains tax exemptions Malena Whitlock, The legislature finds that hawaii has a capital gains tax rate of 7.25 per cent, which is lower than the tax rate many of the state's residents pay on their wages and salaries. Now, individuals pay a top capital gains rate of 7.25%, and corporations pay 4%.

Understanding the Capital Gains Tax A Case Study, The legislature finds that hawaii has a capital gains tax rate of 7.25 per cent, which is lower than the tax rate many of the state's residents pay on their wages and salaries. Inheritance and estate tax and inheritance and estate tax exemption

Capital Gains Tax They apply to most common investments, such as, Discover the complexities of capital gains tax rates and how inflation plays a role. The income tax rates and personal allowances in hawaii are updated annually with new tax tables published for resident and non.

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, The legislature finds that hawaii has a capital gains tax rate of 7.25 per cent, which is lower than the tax rate many of the state's residents pay on their wages and salaries. The bill would increase the tax on capital gains to 11% from 7.25%, and increase the corporate income tax rate to 9.6%.

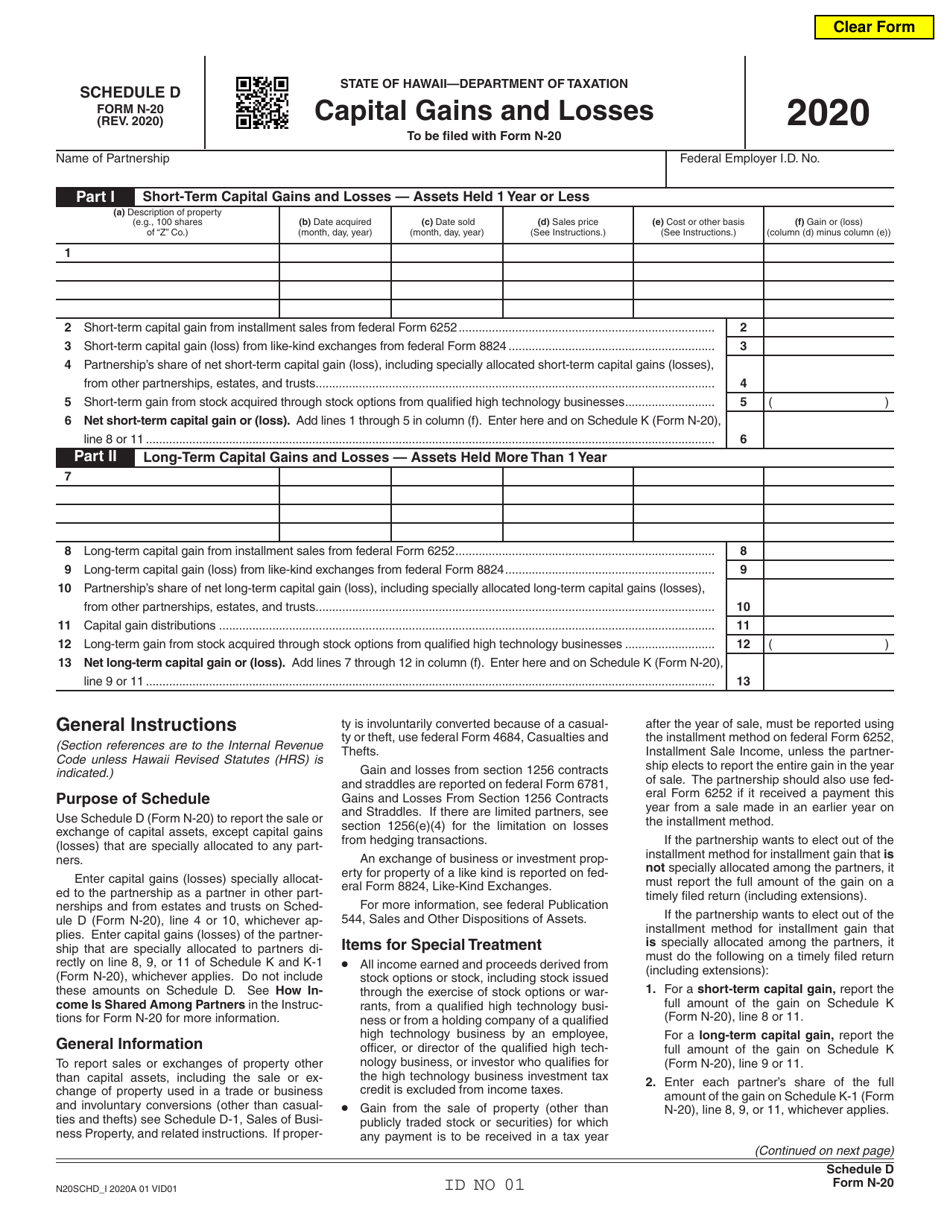

hawaii capital gains tax worksheet Cicely Archibald, Itemized deductions generally follow federal law. The legislature finds that hawaii has a capital gains tax rate of 7.25 per cent, which is lower than the tax rate many of the state's residents pay on their wages and salaries.

How to Calculate Capital Gains Tax on Real Estate Investment Property, The legislature finds that hawaii has a capital gains tax rate of 7.25 per cent, which is lower than the tax rate many of the state's residents pay on their wages and salaries. Taxes capital gains income at the same rate as ordinary income.

Capital Gains vs. Ordinary The Differences + 3 Tax Planning, You are viewing archived information from 2025. Taxable income (single filers) taxable income.

hawaii capital gains tax worksheet Cicely Archibald, The income tax rates and personal allowances in hawaii are updated annually with new tax tables published for resident and non. Hawaii hb232 2025 taxes capital gains income at the same rate as ordinary income

State Taxes State Taxes On Capital Gains, Hawaii hb232 2025 taxes capital gains income at the same rate as ordinary income You earn a capital gain when you sell an investment or an asset for a profit.

hawaii capital gains tax worksheet Cicely Archibald, The income tax rates and personal allowances in hawaii are updated annually with new tax tables published for resident and non. Taxpayers with federal adjusted gross income over certain thresholds.

The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations.