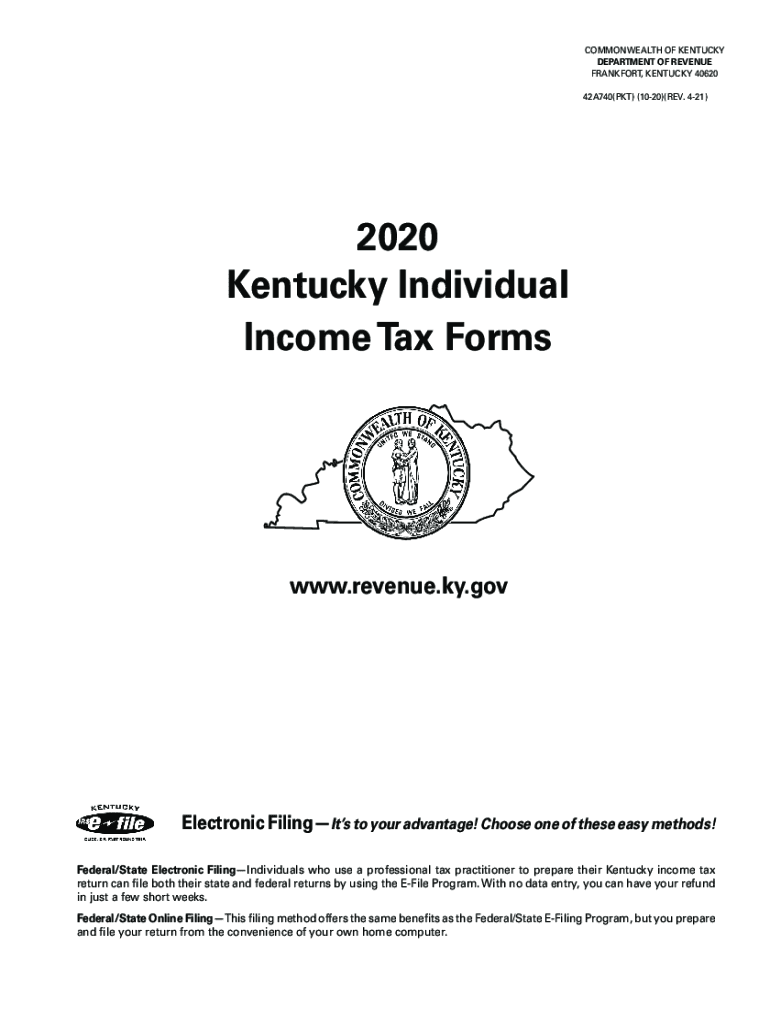

Kentucky Withholding Tax Table 2025. 1 published revised information on withholding tax tables and computer formula, effective for tax years beginning jan. State of kentucky on november 5, 2025.

Frankfort — kentucky’s budget is set to include 3% pay raises for state employees and modest education spending increases, but no dedicated pay raises. Kentucky has a flat income tax of 4.5% — all earnings are taxed at the same rate, regardless of total income level.

Tax Calculator California 2025 Barb Marice, The withholding taxes are calculated by: Welcome to the income tax calculator suite for kentucky, brought to you by icalculator™ us.

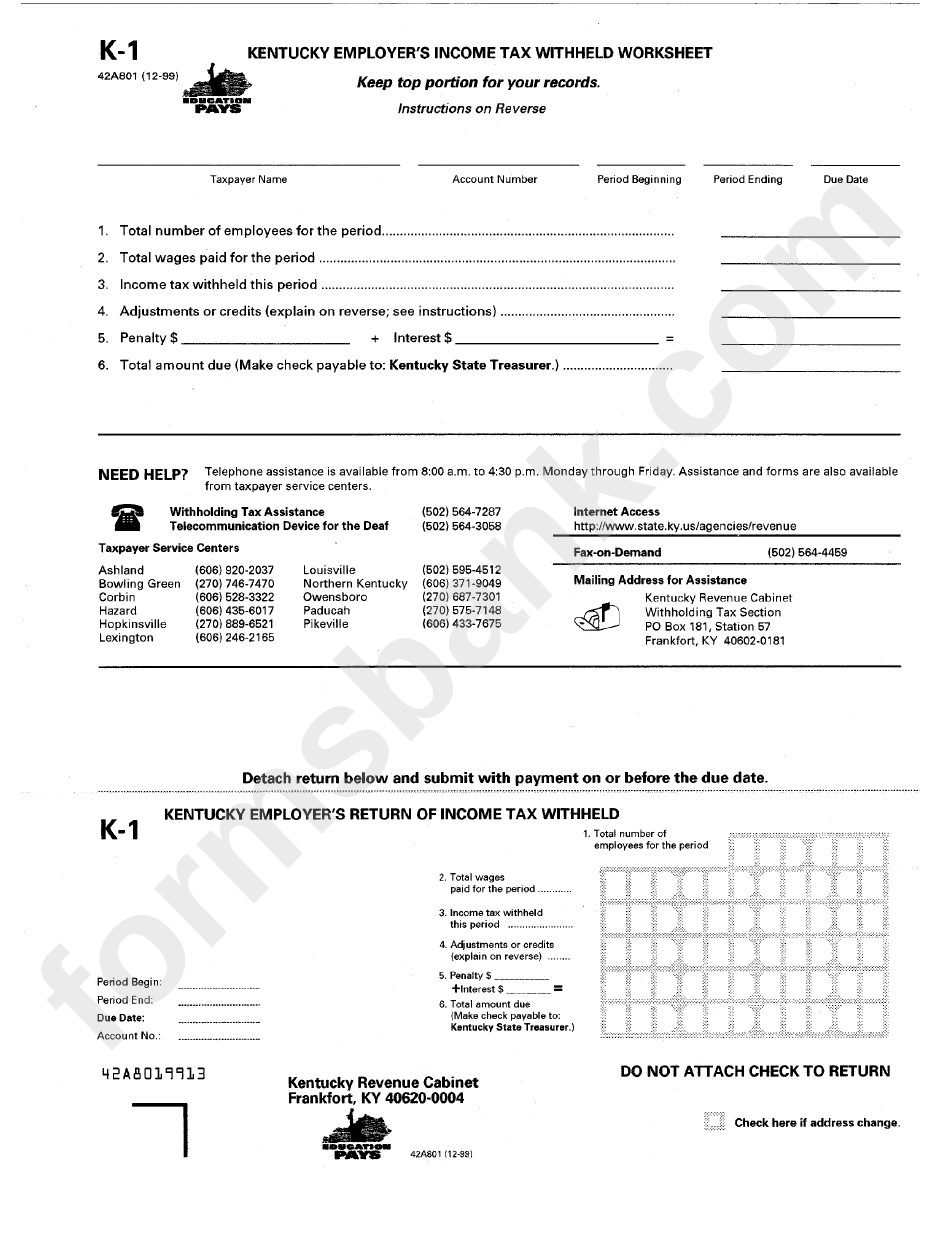

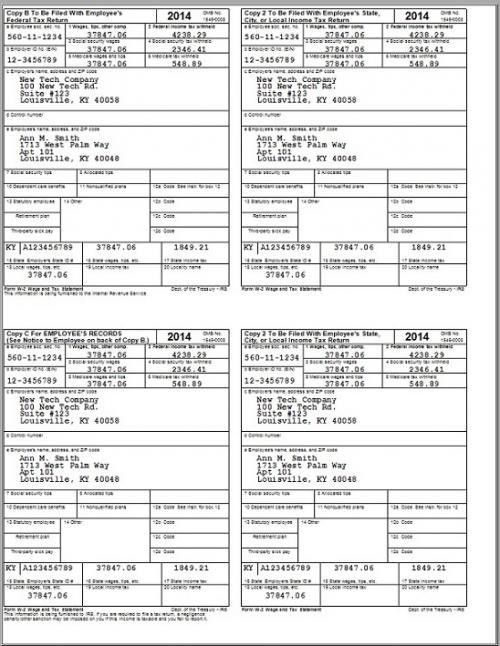

Ky State Tax Withholding Form, 1 published withholding tax tables and computer formula information, effective for tax years beginning jan. The tax tables below include the tax rates, thresholds and allowances included in the kentucky tax calculator 2025.

2025 Ky State Withholding Form, (survey update as of january 10,. How to calculate 2025 kentucky state income tax by using state income tax table.

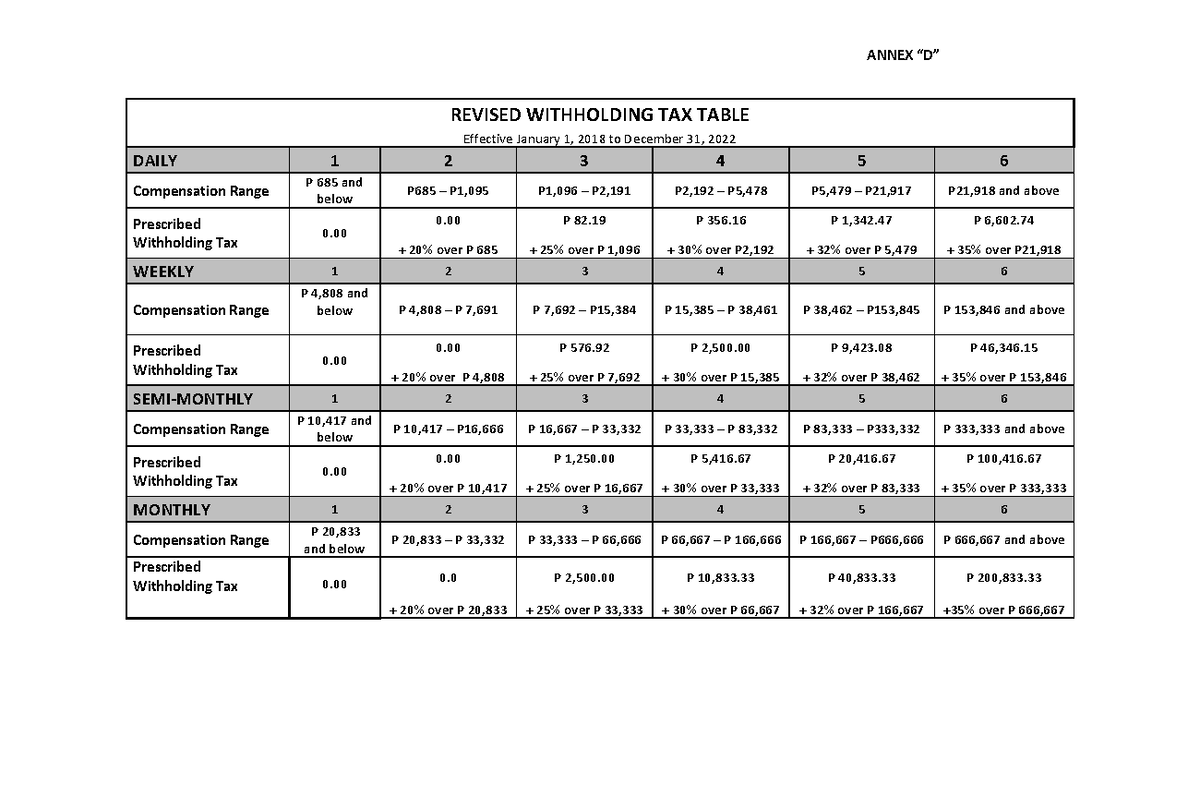

Revised withholding tax table, inilabas na ng BIR para sa TRAIN, Kentucky state income tax tables in 2025. The publication also includes the 2025 withholding tax formula with examples and calculations.

Kentucky Tax 20202024 Form Fill Out and Sign Printable PDF Template, Kentucky single filer standard deduction. The latest state tax rates for 2025/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states.

RR112018 AnnexD RevisedWithholdingTaxTable 20182022 (Philippines, 2) subtracting the annual deduction to give state. The tax tables below include the tax rates, thresholds and allowances included in the kentucky tax calculator 2025.

Kentucky Withholding Tax Table 2025 E Jurnal, (september 1, 2025) — each year, the kentucky department of revenue calculates the individual standard deduction in accordance with krs 141.081. Use our kentucky payroll calculator for the 2025 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions.

Withholding Tax Table, The publication also includes the 2025 withholding tax formula with examples and calculations. It has the highest median household income in kansas, being in excess of $250,000.

2025 Tax Brackets What You Need To Know aeasecondlife, A general election will be held in the u.s. The primary election for all offices will be held on may 21, 2025.

Kentucky State Tax Rate Calculator » Veche.info 9, The publication also includes the 2025 withholding tax formula with examples and calculations. The income tax rates and personal allowances in kentucky are updated annually with new tax tables published for resident and non.